In collaboration with a fantastic team, we recently did in-depth research into the digital strategies of some of the world’s top digital-first banks, FinTechs and tech giants. We wanted to answer 1 question: What makes people not only love a product, but keep using it and advocate for it?

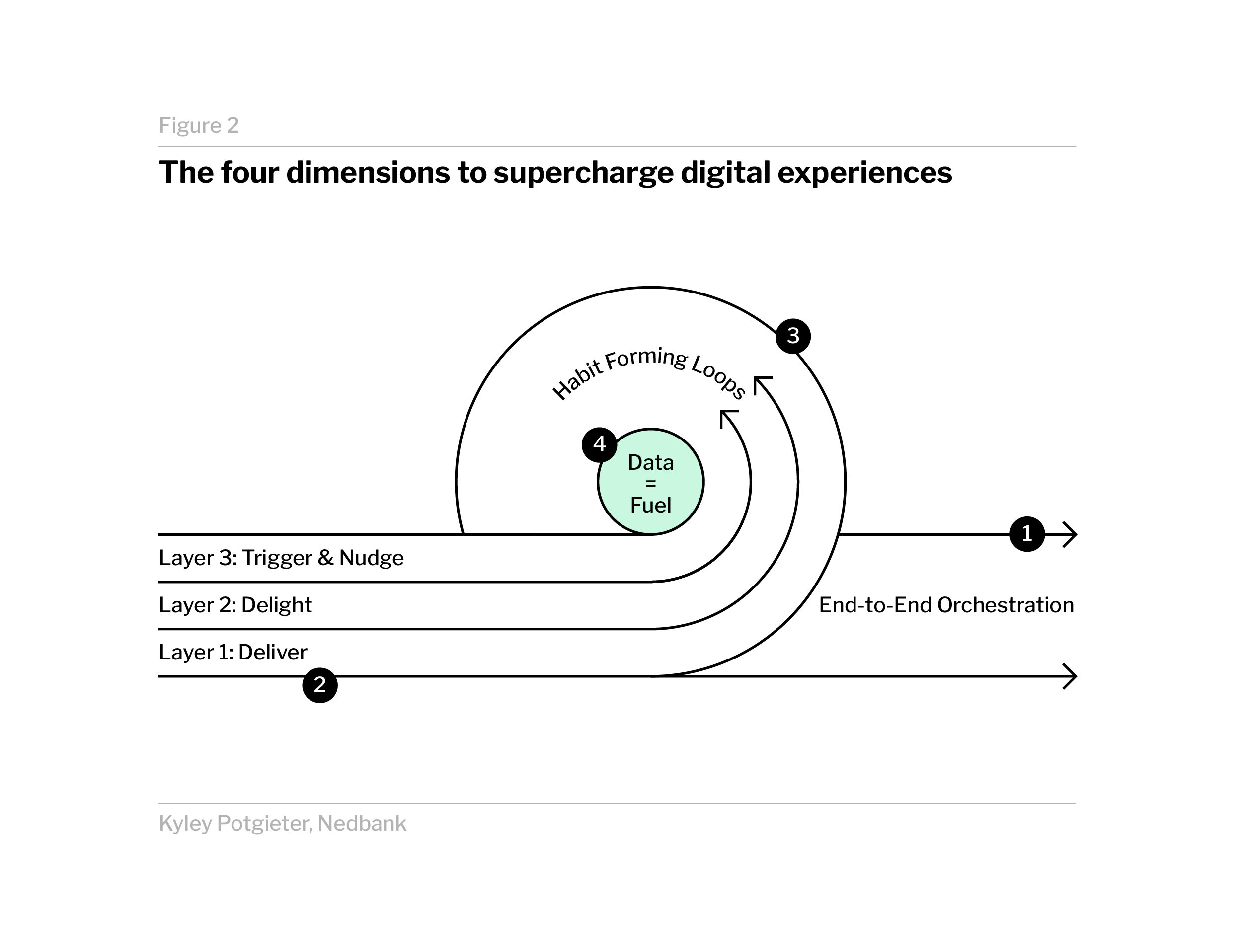

This research has helped us to identify the common themes in how these giants have mastered successful experiences. Here are the 4 dimensions we’ve observed that are needed to supercharge digital experiences.

- A relentless obsession with mastering the funnel.

- Experiences are multi-dimensional and to stand out in a crowded market, 3 layers of experience are needed.

- The way to build lasting user engagement is through habit-forming loops.

- Data is the fuel that enables a rich and personalised experience. Without it, the client experience would be a generic and purely functional experience.

Let’s unpack these 4 dimensions.

Dimension 1

Relentless end-to-end orchestration: Mastering the funnel

A standout across all top brands is their relentless focus on every stage of the customer journey, from awareness to retention. They coordinate every touchpoint, ensuring transitions are smooth and frictionless.

At the top of the funnel, brands like Apple and Commonwealth Bank excel at crafting compelling content that hooks the right audience. They focus on drawing people in with targeted messages that address real needs.

As we move into the consideration phase, Accenture Song Creative Chairperson, Nick Law’s idea of the conversion funnel evolving from the traditional upside-down pyramid into an ‘onion’ comes into play.

The funnel now bulges in the middle, with a dynamic and expanding consideration set.

Law suggests that, today, people are well-informed and spend their time comparing options, reading reviews, and looking for validation from their networks. Brands like Google and Airbnb have nailed this phase by providing users with tools that make research and comparison easy and transparent.

The conversion phase is when people are ready to act, and it’s at this point that simplicity is important. Brands like Revolut and Monzo, with their fast, streamlined onboarding processes, ensure users can get started without frustration. A complicated or slow sign-up experience can lead to people swiftly quitting the process. It’s all about balancing information gathering with simplicity.

Finally, retention involves creating the habit-forming loops that encourage ongoing engagement. Leading brands continuously deliver value through insights, features and reminders that keep their clients coming back, long after the initial conversion.

Dimension 2

The 3 layers of experience: Standing out in a crowded market

Layer 1: Deliver

At a baseline, your product must solve users’ pain points seamlessly, delivering on the product’s core use or purpose in the simplest, most seamless way. ING focuses on removing friction from the process to make sure clients get what they need with the least effort. Whether it’s making payments, accessing savings, or managing a budget, brands like ING make sure that the fundamental service they offer is reliable and efficient.

Layer 2: Delight

Surprise and delight are what sets great brands apart from the rest. Think of Uber’s ‘peak-end’ principle – a customer experience strategy where Uber focuses on creating memorable high points (peaks) and positive final moments (ends) during a ride to leave a lasting impression, making users more likely to return and recommend the service. In banking, these ‘peaks’ or ‘moments of delight’ could be a birthday reward, a seamless loan application experience, or just a well-timed message congratulating you for achieving a savings goal.

Revolut and DBS do this by gamifying the experience, rewarding users for actions like saving regularly or reaching financial milestones, and highlighting these moments with playful animations that turn financial management into a more engaging and fun experience.

They also offer surprise incentives like fee waivers, small rewards, or personalised discounts based on users’ behaviour. These delightful surprises drive loyalty and advocacy, encouraging customers to share their positive experiences.

Layer 3: Trigger and nudge

Top brands trigger and nudge behaviour through multi-sensory interactions – motion, sound, or personalised nudges based on rich, real-time insights. Apple is a master of subtle but effective nudges, using haptic feedback and sound in their user journeys. Shoprite X, for example, uses data to personalise nudges that guide customers through their grocery-shopping journey – think suggestions for healthier choices or a reminder to restock essential items.

Here, though, brands must be careful – crossing into the ‘creepy’ zone is a real risk. A well-done nudge? A reminder that your travel insurance is due right after you’ve booked flights – perfect timing. Too far? Getting a notification about luxury spending rewards or increasing your credit card limit just after you’ve visited a high-end retail store, making it feel like your movements are being tracked.

To stand out today, delivering a good experience isn’t enough. You must hit 3 layers of experience: Deliver, Delight, Trigger and nudge.

Dimension 3

Habit-forming loops: Building lasting user engagement

A hallmark of the top players in the digital-banking, fintech and tech world is their mastery of habit-forming loops. Whether it’s Apple Watch nudging you to close your movement rings or Monzo gamifying savings targets, these brands understand how to create small but meaningful habits to make sure that their customers return time and again.

The ING app, for instance, offers personalised financial insights to help clients manage their budgets better. By nudging them with the right suggestions at the right time (like saving a little extra with each transaction through round-up and save) they create value that keeps their clients coming back for more.

Whether it’s through rewards programmes, daily use prompts, or reminders to complete a task, these brands have embedded behaviours into their digital ecosystems that keep clients engaged long after their initial sign-up. The goal is simple: make using the product a habit and not a chore.

Dimension 4

Data as the fuel

None of this is possible without the fuel – data. Data powers everything – from personalising onboarding flows to ensuring the nudges are relevant.

For instance, Monzo uses transaction data to offer personalised budgeting tips and insights. They let users see exactly where their money is going and offer timely suggestions to save more or avoid overspending. Revolut employs data-driven insights to create specialised recommendations, so their clients see only offers and financial products that are truly relevant to them.

Behavioural analytics and AI-driven insights help brands anticipate what clients need before they realise it themselves

By applying behavioural analytics and using AI-driven insights, these brands anticipate what users need before they even realise it themselves. Whether it’s real-time insights or long-term behavioural data, this fuel enables brands to continually refine and elevate the client experience.

The winning formula in product design

This 4-dimensional approach lays out a path to creating digital products that aren’t just useful, but also loved. From retail or commercial banking to global tech platforms, the winning formula is clear – obsess end-to-end, deliver an experience that solves pain points seamlessly, delight users with unexpected moments, and nudge them toward healthy, engaging habits. And, most importantly, let data be your guide.

The takeaway? These brands show us that the best experiences are not accidental – they’re deliberate, concentrating on client-centred design, smart data orchestration, and a relentless focus on habit formation.

In an era where people have so many brands competing for their attention, this approach can help us stay ahead as designers – creating not just products, but experiences that users feel they can’t live without.